Today, independent schools are using their independence to frame employee benefits in new ways to attract and retain the best and the brightest. They are shifting their approach to a more employee-centric ecosystem of health and wellbeing for their faculty and staff, rather than isolated offerings of health insurance and perhaps a separate wellness program. One way to make the most of a school’s spending on benefits is to make data-informed decisions. A self-funded health insurance model gives schools significantly more data to understand the needs of a community and to tailor benefits accordingly.

The Bottom Line

- Health insurance costs are set to spike close to 9% on average this coming year due to higher health care costs. Schools will want to make the most of every dollar spent.

- Self-funded health insurance plans provide an abundance of data that can help schools tailor their benefits to their employees’ needs.

- If a school sees a spike in mental health claims, for example, leaders can provide more benefits in that area. Data can also suggest areas for partnership.

Nationally, employers are bracing for the largest 10-year increase in health insurance costs with forecasts as much as 8.8% due to medical inflation, rising demand for costly weight loss drugs, wider availability of high-priced gene therapies and an epidemic rise in mental and behavioral health related treatments.

Net Assets magazine previously reported that for every 10% increase in health insurance costs, there is a 1% increase in tuition. Those increases are not the best uses of our schools’ resources.

Data-Informed Benefit Plans

There are three things you can do with risk – retain, share or transfer it. When your school buys a fully insured plan and transfers all its risk, you pay a premium that is fully taxable (2.5%–3%) and includes carrier profit built into that premium. In addition, a school gives up all control of plan design and data-access to that carrier. In practice, you have little insight into what you are paying for.

By contrast, in the self-funding model, you have more control of your plan and its financing, and receive intelligence to improve the performance, cost and overall value of the plan you chose — a large part of the operating budget. Self-funding models, which may take the form of a captive or consortium or may be financed on your own if your school is large enough, give you more flexibility to finance the plan the way you see fit and access to the data about what employees use and don’t use.

Improving School Culture

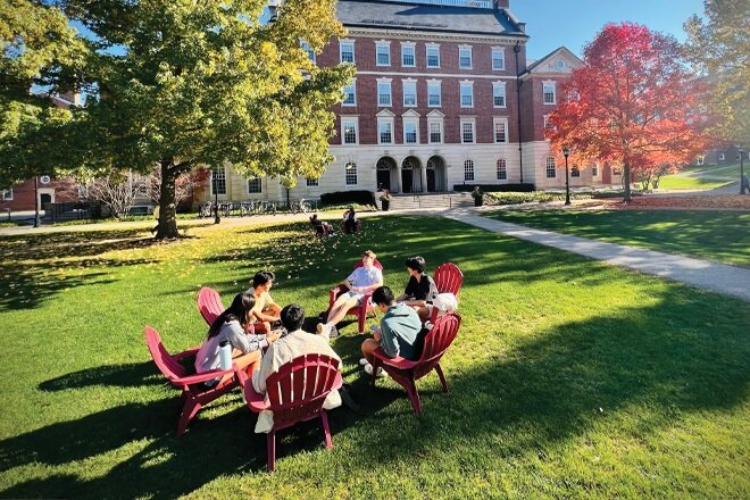

There is an old mantra in the world of leadership: “Whoever has the best data wins.” Dirk DeRoo, director of compensation and benefits at Phillips Exeter Academy in Exeter, New Hampshire, notes a shift in labor demographics and expectations. The “NextGen” labor force is more attracted to employers who create a thriving, flexible and engaged work environment, with a focus on culture, which has always been a hallmark of independent schools, De Roo said.

In 2017, Exeter transitioned into Borislow’s self-funded health insurance group-purchasing consortium Captivated Health. Since then, DeRoo has been able to mine data from the plan bi-weekly for 15-30 minutes through his access to the program’s analytics engine. All data is HIPAA-protected and de-identified while providing insight on Exeter’s employees and families, and importantly helps DeRoo pinpoint where the plan can offer more support.

DeRoo has had a front seat to the alarming trend of behavioral health claims, which unfortunately we see across all schools, specifically with students aged 15-19. Costs in this area have risen as much as 500% in recent years. In response, DeRoo created a partnership with six mental health counselors to provide more support to families. He is also helping members further their education in this area through a series of 30-minute Zoom calls. He noted that according to the CDC, loneliness is the number one driver of mental and behavioral health challenges for Gen Y & Z, the age cohort Exeter is hiring the most, and they need and want that help and support. In addition, Exeter introduced the Calm app to help with meditation and mindfulness, and nearly 400 employees signed up.

Surplus from the captive and prescription plan, which provides rebates, fund these newer benefits. The school “boasts a 48.6% engagement rate in the benefits plan, clearly demonstrating the positive impact on our employees and school culture.”

Exeter also conducts a regular health and wellness survey. Recently this showed the top concern for employees was physical health, closely followed by financial wellbeing, more specifically, managing debt, budgeting and saving for the future. The school has responded to this need and democratized its approach to financial wellbeing by introducing NorthStar, an organization of independent certified financial planners that can help faculty and staff improve their financial wellbeing and mental health as well. As with the offerings discussed above, the captive surplus and prescription rebates make this benefit possible without increasing employee costs.

Improving Employee Health

Harpeth Hall of Nashville, Tennessee, joined Captivated Health in 2020, and since then has emphasized the importance of primary care for its employees. Employees receive an extra $150 HSA contribution as incentive for seeking annual physicals, and the plan reports an 80% engagement rate.

CFO Tom Murphy implemented Dario, a service that delivers end-to-end care and support for members with mental health issues, musculoskeletal (backs, hips and knees) issues and metabolic syndrome (diabetes). According to Murphy, the service “created a buzz on campus because it offers tools and resources for our employees that they have never had before.” The school’s original goal was 30% engagement after one year. As it played out, they reached 42% engagement after four months, he reported.

Murphy shared how a pre-diabetic faculty member engaged with Dario and received free medical supplies to help her manage her condition, including a special scale and glucose and blood pressure monitors. The employee reported that “this program was just the push she needed to take control of her diabetes and thanked him for helping to change her life.”

Like DeRoo, Murphy mines the school data with the analytics portal, including large claims, to see what can be done to help members and lower costs. He noticed three out of five large claims were related to maternity. Through the captive program, Harpeth Hall contracted directly with Vanderbilt University Medical Center, which offers bundled contracts for maternity care, with the goal to improve the quality of care and lower maternity costs. Members may elect to receive maternity services at Vanderbilt, which saves the school $10,000-$30,000, while receiving concierge level service during their entire pregnancy through 12 weeks post-delivery. Employee incentives to participate in the Vanderbilt bundled maternity program include free diapers and wipes to member participants for one year from the date of birth.

In Sum

It’s clear that the traditional model of health insurance and wellness programs is evolving. With health insurance costs on the rise, it’s essential that schools make the most of their resources. More and better data, which is a given with a self-funded model, can help school administrators make the most of their spending, enhance their school culture and community, meet employee needs and keep everyone healthier.