Article by Chad Stacy, Dunn School

The charged atmosphere in the Earwig Café on a football Sunday rivals that of a packed sports bar. Students share high-fives, exchange verbal jabs and engage in heated games of Madden Football while a real football rivalry plays out on the big-screen TV. The teenage clientele eagerly order iced coffee, pizza and ice cream—then fire off texts inviting their friends to join them.

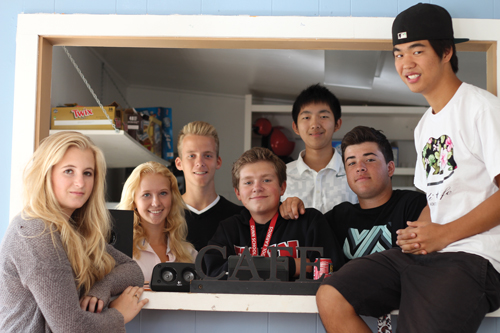

While dozens of satisfied customers cheer and socialize, several of their classmates are hard at work, earning academic credit, learning business skills and raising money for their investment portfolio as the student managers of Dunn School’s Earwig Incorporated.

Dunn School has an impressive track record of developing successful entrepreneurs. Situated on California’s central coast, surrounded by vineyards and oak-studded golden hills, the school’s culture has always valued creativity, original thinking and the wholehearted pursuit of one’s passions.

What we didn’t have until recently was a formal academic program to teach entrepreneurship and business skills to our students.

Origins of an Entrepreneurship Program

In 2008, Dunn experienced its first head of school change in 15 years. The new head, Mike Beck, envisioned an academic culture in which curricular innovation could flourish. To encourage the process, the administration could simply say ‘yes’ to faculty and student passions much more often than it said ‘no.’

A perfect test case arose the following summer, when Mike was approached by incoming senior Sunny McCluer, an energetic student with a bold idea: Why not create a campus café for students, managed by students?

Along with his blessing and a $5,000 loan for inventory and furniture, Mike gave Sunny access to a small former faculty apartment within a football toss of the dining hall. Sunny and her friends did the rest. They spent the summer converting the apartment into The Earwig Café, where they went on to sell snacks and drinks and recruit other students to sign on as volunteer employees. By the end of the first year of operation, Sunny and her team had paid back the loan and generated an additional $5,000 in profit.

The success of the Earwig Café inspired Dunn School to initiate two complementary business programs: the Earwig Foundation, an investing program whereby students invest the profits from the Earwig Café in a fund of the school’s endowment, and Earwig Innovations, an entrepreneurship program that teaches the Lean LaunchPad method of business startups.

Today, the three programs are combined into a formal business curriculum in an elective class called Earwig Incorporated. Covering entrepreneurial studies, business management and investment management, the class runs for the entire year and is open to all students in grades 9–12.

Learning by Doing

Dunn School’s student managers have outperformed the S&P 500 by a compound annual growth rate of more than 4 percent since May 2011, the account’s inception.

Whether managing the business operations of the Earwig Café or investing its profits into a market-beating investment portfolio, students are delivering their own real-world curriculum in a very positive way. For starters, the program’s financial results have been remarkable. The Earwig Café generates an average of more than $10,000 in net income each year. The Earwig Foundation’s fair market value exceeds $57,000 and provides an annualized return of 18 percent, putting it on a trajectory to reach its goal of $1 million by 2028. Dunn School’s student managers have outperformed the S&P 500 by a compound annual growth rate of more than 4 percent since May 2011, the account’s inception.

Moreover, the Earwig curriculum is multi-disciplinary because students must go beyond the world of business and finance. They seek to identify customer needs through surveys and interviews; they hypothesize and test creative solutions to their business problems; they pitch their solutions to their peers and stakeholders; they market and execute their initiatives; they analyze results and study lessons learned from the process.

Earwig Incorporated is an excellent vehicle for building teamwork and communication skills. While managing their business and their investments, students typically work in groups of three or four. Since each member brings a different skillset, students come to understand the worth of their own specific strengths. And, they are required to promote the results of their various enterprises throughout the year, in a process that helps them sharpen their analytical talents, hone their presentation skills, and give and receive constructive feedback.

Their audiences range from small peer groups who provide informal feedback to larger groups of business executives who may provide funding. In one such presentation, a student and former faculty member were on a team that won a Santa Barbara business startup competition, received venture funding and led to NextMover, a technology company connecting consumers planning to move with nearby truck owners. Students also present ideas for approval to school administrators. As a result, this year we are adding French doors to the café (to improve customer flow and take advantage of the deck), along with new technology, furniture and menu choices.

Teamwork, analysis, creativity, communication, presentation and execution aren’t uniquely helpful for future business leaders. The skills that Earwig Incorporated builds are equally important for future doctors, musicians, teachers, architects, designers, accountants, engineers, lawyers, nonprofit managers—any profession in the modern world.

Motivation Beyond Grades

Entrepreneurs often excel precisely because they are motivated differently from their peers. They flourish when allowed to identify problems and find creative solutions.

Likewise, successful Earwig Incorporated students are motivated by their customers’ satisfaction and the achievement of their business goals. Classroom grades are secondary. Throughout the academic year, students compare their Earwig Café earnings with those of previous years. They compare the market performance of their portfolio companies against those of their peers and industry benchmarks. They learn that the business decisions they make every day can have a direct impact on the achievement of their goals. To better meet customers’ needs, they may alter the café’s menu or vary its hours of operation. To deepen customer engagement, they may choose to promote a Super Bowl party or art show. Whatever the students choose to do, the choice is theirs, and they must live with the results.

Linking Alumni and Students

Another benefit of the Earwig Incorporated curriculum is its unique way of both linking learning to the past and projecting it forward. Because the café and foundation are continuing programs, students constantly build off the successes of those who came before them. In turn, they pass on the operations plan, net income and investment portfolio to those who will follow.

The class aims to host at least 10 expert guest speakers each year. Speakers have included program alumni such as Sunny McCluer, founder of the Earwig Café, and Alex Keheya, faculty founder of Earwig Innovations and CEO of NextMover. Other speakers have included Steve Blank, a Stanford professor, entrepreneur and creator of the Lean Launchpad method of startup development, and Tim Bliss, a venture capitalist. Students are encouraged to add guest speakers to their LinkedIn and Facebook networks and reach out to them as they go through the class and onto their business careers.

A core tenet of the Earwig Foundation’s investing philosophy is to “hold forever.” This policy offers several wonderful long-term results. First, students who know that the school will hold their investments forever are much more thoughtful about the initial purchase. They also naturally form ties to the investments that they personally recommend. As they stay connected with the school as alumni, they ask and are reminded about their contribution to the portfolio. Their learning continues as they see how their initial investment thesis plays out.

When the Earwig Foundation account reaches its goal of $1 million, it will begin to provide scholarships. The school intends to create a committee of current and former Earwig Incorporated students to manage the scholarship distribution process. This effort will provide a formal forum for active alumni of the program to continue to engage in it while also creating another worthy curricular goal: philanthropy.

Blueprint for the Business Office

While every business officer’s situation is different, I have found it is possible and fulfilling to get involved in the academic side of my school. Each year, I have co-taught Earwig Incorporated with another full-time faculty member. This is ideal, as we bring different skillsets and experiences to the classroom. Plus, the shared teaching load means I can bow out during intense periods in the business office: audit season, budgeting or before a board of trustees meeting.

As business officers, we are passionate about the success of our schools. We are often charged with leading our schools down the path toward financial sustainability. There is no more important sustainability initiative than ensuring that our schools offer dynamic programming that provides our students with 21st century skills and binds them to the institution over their lifetime. By tapping into our community’s passion and ideas, we have created such a program at Dunn School.