Many schools lack the level of unrestricted net assets they need to have an appropriate level of financial flexibility. As opposed to assets that are restricted by donors for a specific purpose, unrestricted net assets can be allocated where an organization needs them the most, whether it is operations, capital improvements or strategic initiatives. Unfortunately, many times a school’s net assets are tied up in capital and restricted funds. Independent schools have focused their resources on enhancing the academic experience and making capital improvements, with the unintended consequence of depleting unrestricted assets. We recommend that schools create a plan to boost unrestricted net assets and build financial flexibility for the future.

Case Study 1

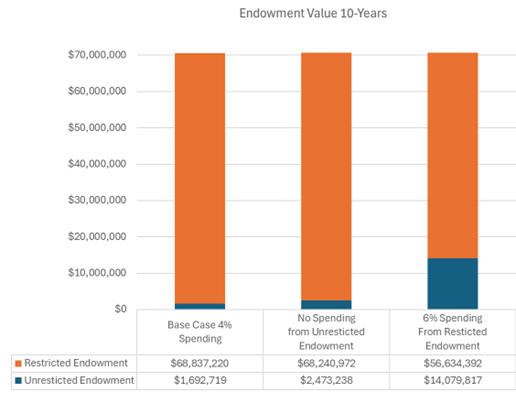

The below example is for a school with a $70 million endowment, of which only $1.7 million, or 2%, is unrestricted. The organization has a spending rate of 4% annually from the endowment, using the same spending rate for both restricted and unrestricted endowment funds. There are several options to grow the unrestricted endowment.

Scenario 1 – One path is to stop spending from the unrestricted endowment and spend a little more (4.4%) from the restricted endowment. By doing this year-after-year, the organization will be able to grow its unrestricted endowment incrementally over the 10-year period. In this scenario, net assets increase by $780,519 (the difference between the first and second column in the chart below).

Scenario 2 - An alternative, more impactful plan is to raise spending from the restricted endowment to 6%. This will generate more endowment payout, but rather than putting the additional money into the operating budget, the school will continue to budget for a 4% endowment distribution and use the operating surplus to create an unrestricted endowment.

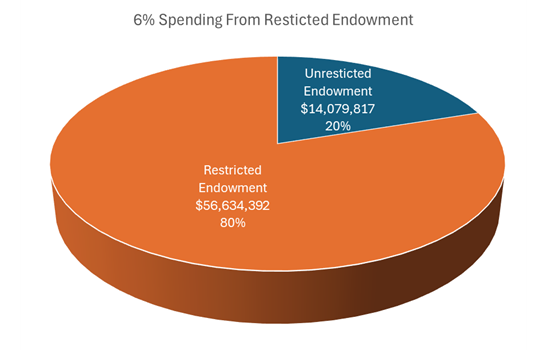

In this second scenario, the unrestricted endowment assets increase from $1.7 million to $14.1 million over 10 years. The unrestricted endowment grows to 20% of the total endowment value. This increase vastly improves the ability of the school to dedicate resources where they are needed the most.

Case Study 2

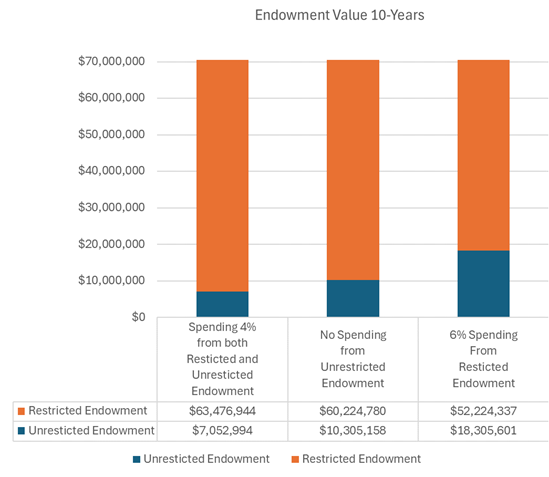

Let us look at a different school with a higher level of unrestricted assets: $7 million or 10% of its $70 million endowment.

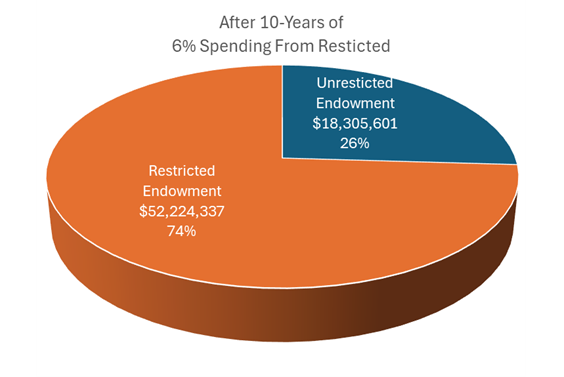

Using a 6% spending rate from the restricted endowment, the school can significantly grow the unrestricted endowment, but not at the same level as in Case Study 1. Over 10 years, the unrestricted endowment would grow from $7 million to $18.3 million, comprising 26% of the total endowment.

In both cases above, the school would benefit significantly from differentiating the restricted endowment spending rate from the unrestricted endowment spending rate. In addition to providing more financial flexibility, using a higher spend rate for restricted endowment will significantly improve your school’s ability to secure financing. Having a greater unrestricted endowment and a surplus will make your operations appear stronger and strengthen the operating ratios that are critical to lenders.

Essential Considerations

Before a school goes down this path, leaders should be aware of some very important operational issues:

- Donor restrictions must be satisfied. You need to have an operating expense that satisfies the donor restriction. If you are not able to satisfy the donor restriction, you cannot create an unrestricted endowment with this additional payout. Nothing in this scenario eliminates the need to legally satisfy the donor restriction.

- Donor relations must be maintained. The optics of altering your spending need to be managed. A donor could believe you are overspending from their endowment. To manage this, some organizations create an unrestricted endowment and attach it to the restricted endowment fund. For reporting, the donor will have an endowment statement with two components, a restricted and unrestricted component. While this is not necessary, it may be the best path to maintain strong donor relationships.

- UPMIFA (Uniform Prudent of Institutional Funds Act) has important implications. Each state has laws that outline spending from endowments where the current market value has fallen below the book value. By increasing the spending rate on restricted funds, you are also increasing the possibility of having underwater endowments. To guard against this outcome, you may choose to only spend at a higher rate from the older established endowments that have significant market appreciation.

As a result of these concerns, you need to have a robust plan that is well understood by all related parties. Most importantly, your total spending rate should remain unchanged. The board and school leadership need to be budget hawks to ensure that you are not spending more, as it will defeat the purpose of this exercise.

Start Today

The amount of unrestricted net assets needed by an organization varies depending on factors such as its size, mission, revenue volatility/predictability, condition of the capital plant, fixed vs. variable operating expenses, and future plans. Generally, having a sufficient reserve of unrestricted net assets ensures financial stability during unexpected events or economic downturns and provides flexibility to pursue strategic opportunities or address emerging needs without relying solely on external funding sources.

It is wise to start building your school’s unrestricted endowment today. While you may not need it now, the process of building unrestricted endowment takes time and will pay off when the need arises for financial flexibility in the future.