(from New Pinnacle Consulting Group, The Tax Adviser and Accounting Today) The IRS recently released two announcements that impact independent schools.

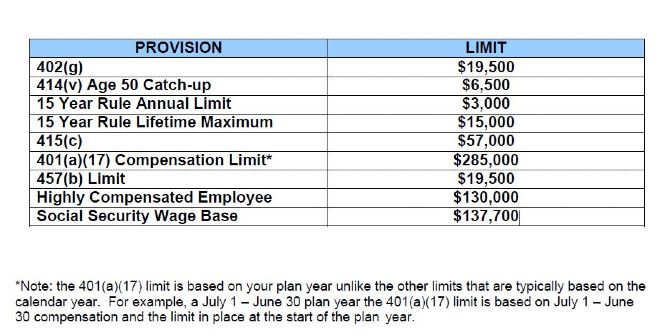

The first regards new retirement plan limits for 2020. The 402(g) limit increased to $19,500, 401(a)(17) Compensation Cap increased to $285,000 and the 415(c) limit increased to $57,000. The age 50 catch-up increased to $6,500. Retirement plans (including 403(b) plans) are subject to these limits.

Secondly, the 2020 Form W-4 (Employee's Withholding Allowance Certificate) has been extensively revised in response to feedback from the payroll and tax community to simplify how taxpayers calculate their income tax withholding. The form implements changes from the Tax Cuts and Jobs Act. The new Form W-4 eliminates the use of withholding allowances, which were tied to the personal exemption amount. "The primary goals of the new design are to provide simplicity, accuracy and privacy for employees while minimizing burden for employers and payroll processors," said IRS Commissioner Chuck Rettig.

Employees who have submitted a Form W-4 in any year before 2020 are not required to submit a new form merely because of the redesign. Employers will continue to compute withholding based on the information from the employee’s most recently submitted Form W-4. This summer, the IRS unveiled an improved Tax Withholding Estimator tool to help employees understand what they should withhold. The IRS is once again urging taxpayers to do another paycheck withholdings checkup this year to ensure they have the correct amount withheld for their personal tax profile.

More from The Tax Adviser

More from Accounting Today

Listen to the latest episode of the Net Assets podcast.